how to pay indiana state tax warrant

A service fee will be charged. A service fee will be charged.

Dor Indiana Extends The Individual Filing And Payment Deadline

You must include Your county and warrant number with all correspondence.

. Marketing tax resolution LLC. Please arrange to pay by cashiers check money order or cash. E-Tax Warrant Search Services.

How do I pay a tax warrant in Indiana. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. More information is available in the Electronic Payment Guide.

If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action. Property that constitutes evidence of an.

Paying one-half of that notice within the 20-day response period will provide another new notice to. How do I pay a tax warrant in Indiana. Property that is illegal to possess.

Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and. How do I pay my Indiana state taxes by phone. And 3 Disclaim any.

Can I pay my taxes over the phone. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt.

However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. If you set up an IPA the warrant will remain on file. What is up a past due date of indiana state of indiana tax warrant search follow leads provided.

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. As part of the Tax Amnesty 2015 program eligible taxpayers are allowed to submit a request to have tax warrants expunged. SF 56196 Expungement Request Form.

1 Do not warrant that the information is accurate or complete. We will also notify the Department of State that the tax warrant has been satisfied. Payment by credit card.

Saved Tax Warrant Searches. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR Customer Service and make a payment over the phone using your debitcredit card fees apply Payment plans You can set up a payment plan if you owe more than 100.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Are Ap There For. Set up a payment plan by calling 317-776-9860.

Payment may be made in person at the Spencer County Sheriffs Office or by mail. Our service is available 24 hours a day 7 days a week from any location. Doxpop provides access to over current and historical tax warrants in Indiana counties.

Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue. This web site is it is in. Illinois Street Suite 700.

Payment by credit card. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

Property is possessed by a person who wishes to use it to commit a crime or hide it to prevent the discovery of a crime. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am.

Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders. How to Sign Up. Tax warrants that remain unsatisfied are returned to the Department of Revenue for further action resulting in additional costs to the taxpayer.

User Agreement for e-Tax Warrant Search Services. Your name please spell your name on your message Tax Warrant Number located in the upper right corner of the Tax Warrant Your telephone number s please repeat each phone number twice The amount you will pay each month. Villa Sale Direct From Springs.

No personal or business checks are accepted. You must pay your total warranted balance in full to satisfy your tax warrant. Leave a message with the following information.

You will need to have your taxpayer identification number or Social Security number and Letter ID. What is a tax warrant. Office of Trial Court Technology.

Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. 2 Make no representations regarding the identity of any persons whose names appear in the information.

You might be interested. Paying one-third of the total amount due within the 20-day response period will provide a new notice with a new 20-day due date. Pay by phone Call us on.

Dor Use Intime To Make Non Logged In Bill Payments

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Dor Owe State Taxes Here Are Your Payment Options

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

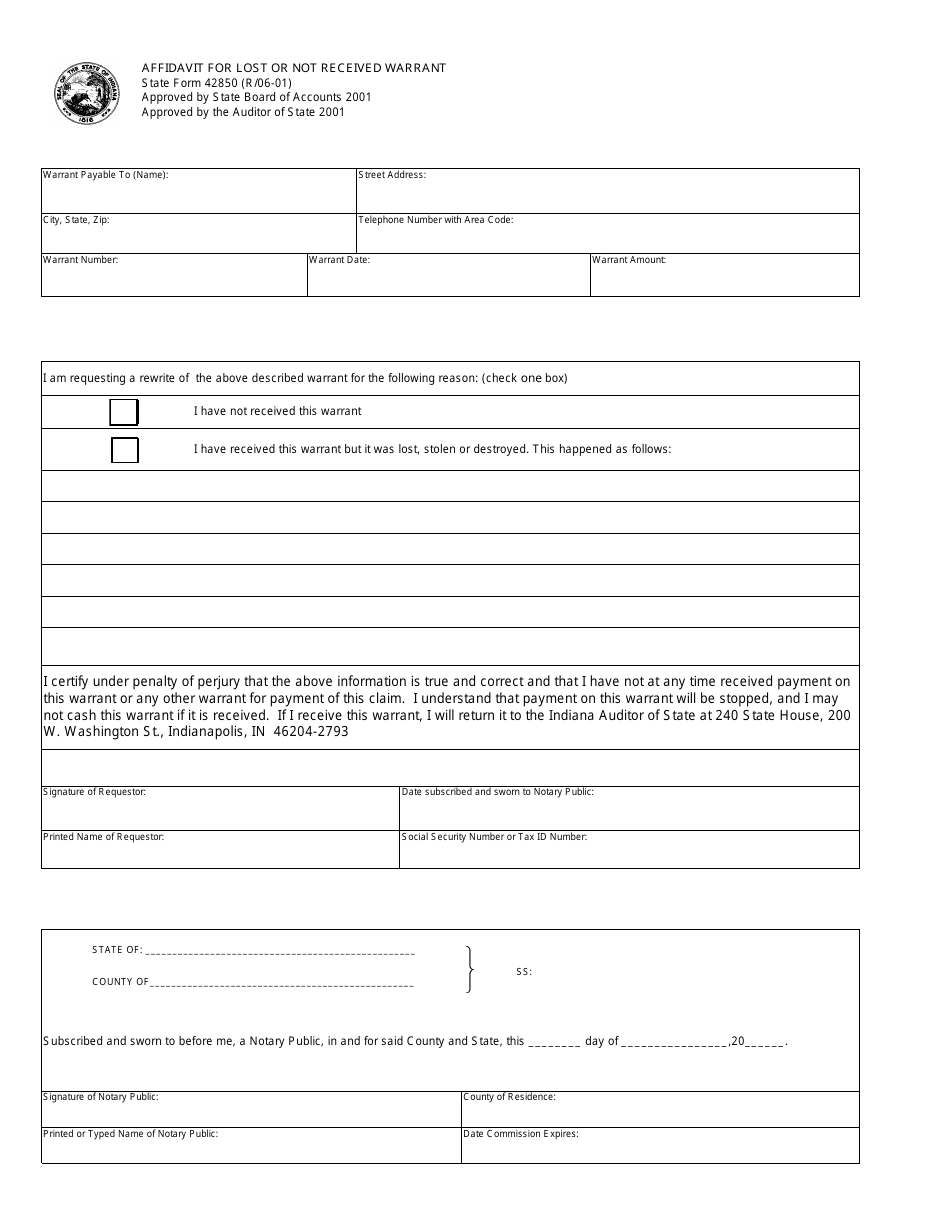

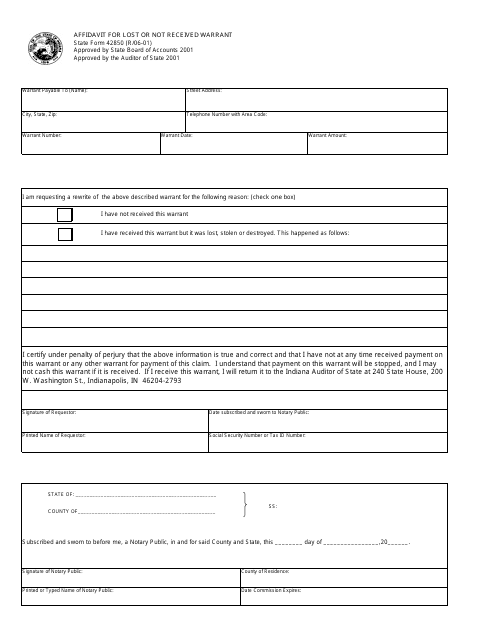

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Indiana Tax Relief Information Larson Tax Relief

Dor Owe State Taxes Here Are Your Payment Options

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Free Federal Tax Lien Search Searchquarry Com

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter